Of the many SBA applications, the CDC/SBA 504 loan is one of the most well-liked—generally mainly because it presents special Gains to businesses that qualify. SBA 504 loans are all about fueling the financial system—they assist business proprietors invest in land or buildings, enhance existing amenities, buy machinery and tools, or buy industrial real-estate. Moreover, they boost position advancement in community communities.

Who qualifies? How about deposits? Will it subject where you make an application for a loan? Permit’s dive into some of the commonest issues we get about business loans and programs.

By understanding your business ambitions, we may help offer a professional real estate loan that achieves your objectives.

Amongst the latest strategies to get startup cash on your business is crowdfunding. Crowdfunding requires running an on-line campaign, where by people can see your task and donate resources. Some strategies require you to satisfy your goal just before any from the resources are produced, while others help you withdraw money the moment They're donated.

Yes, American Express obtains stories from shopper reporting businesses. American Express will even report your funding account payment standing to client credit rating reporting businesses in accordance While using the loan agreement.

But your credit rating rating can affect your level. The higher your score, the reduce the rate. SBA 504 loans are amortized (indicating scheduled debt repayments are made in typical installments) more than 20 years, without having balloon payment.

Evaluating your options is The ultimate way to make sure you’re obtaining the ideal small business loan for the business. Think about the next elements when identifying which loan is best for your needs:

SBA loans are made to help it become less difficult for small businesses to receive funding. When your business has fatigued all other funding solutions, you could possibly get an SBA loan.

Seek out a CDC using a established track record, great assistance providers, and seasoned advisers who can help you type your finances.

Over 800 lenders, Group improvement corporations, and micro-lending establishments are approved to challenge SBA loans. Beneath the SBA’s seven(a) loan guaranty application, the lender offers the loan and also the SBA promises to pay for the lender a part of the loan if the borrower defaults.

Setting up your individual business is remarkable, but additionally jam packed with SBA 504 business loan Nevada difficulties. In an effort to start your business, you require the ideal amount of funding.

We reached out to Wells Fargo Bank to see if there have been any pros to working with them through the SBA loan procedure. Here's what they advised us:

Soon after implementing, considered one of our pleasant Funding Experts will link along with you so we could learn more about both you and your business. Your Funding Specialist can assist solution any thoughts you may have in regards to the loan procedure and assist you learn which loan is the right match for your personal business and economic requires.

Obtaining federal government backing makes it possible for lenders to take on more threats On the subject of giving loans to small businesses. During the 2020 fiscal 12 months, lenders issued a mixed $28 billion in SBA loans.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Tia Carrere Then & Now!

Tia Carrere Then & Now! Katie Holmes Then & Now!

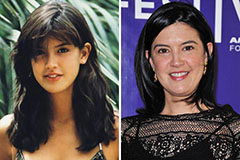

Katie Holmes Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!